Bitcoin has fallen to the $85,000 area and is currently not showing strong signs of recovery from these lows. Ethereum has also dropped below $3,000 and is poised to move toward $2,700.

Meanwhile, the head of the SEC made several statements yesterday regarding privacy in the crypto industry. According to him, blockchain is more transparent than any traditional financial system because every transaction is recorded in an open ledger, which creates certain risks for the future financial system. As a result, cryptocurrency could turn into the most powerful system of financial control when aggressive regulation is applied.

However, the SEC Chairman believes that the complete transparency of blockchain could harm the market. On one hand, the pursuit of full transparency is certainly noble. It creates a semblance of ideal financial democracy where every transaction is visible and understandable. However, as the SEC Chairman rightly points out, such transparency may have a downside. The inability of large players to execute trades discreetly could lead to undesirable consequences, particularly mass front-running. Imagine a scenario where every market player sees a large investor preparing to purchase a significant amount of assets. Competitors would immediately begin to copy that trade, artificially inflating the price and denying the first investor the chance to achieve maximum profit.

On the other hand, a complete lack of transparency is also unacceptable. Blockchain, like any other financial system, must be protected from abuses such as money laundering, financing of terrorism, and other illegal activities. The government must have the means to identify and combat these threats without violating citizens' rights to privacy and the protection of their personal information.

"Privacy tools in crypto should reduce, not increase, the need for total financial control. This is the path to safeguarding freedom and stimulating innovation," the SEC Chairman stated.

As for the intraday trading strategy on the cryptocurrency market, I will continue to focus on major dips in Bitcoin and Ethereum in anticipation of further bullish market development in the mid-term, which has not disappeared.

Regarding short-term trading, the strategy and conditions are outlined below.

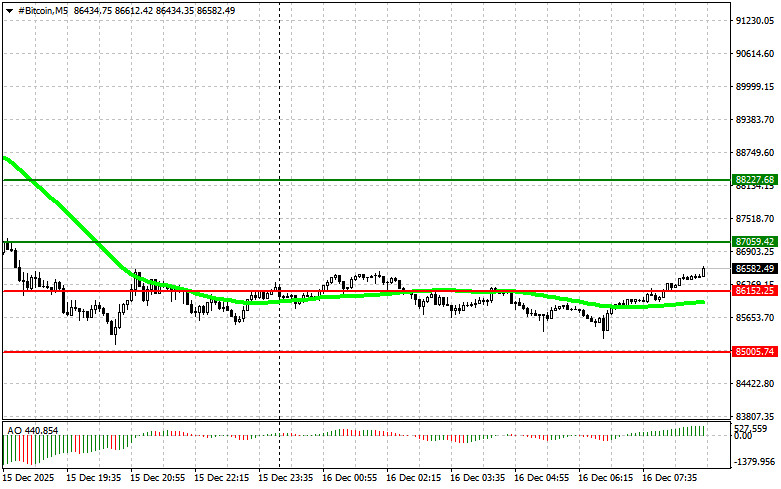

Bitcoin

Buy Scenario

Scenario No. 1: I plan to buy Bitcoin today upon reaching the entry point around $87,000, targeting growth to the level of $88,300. At around $88,300, I will exit my buys and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome oscillator is above zero.

Scenario No. 2: I can also buy Bitcoin at the lower boundary at $86,100 if there is no market reaction to its breakout back towards $87,000 and $88,300.

Sell Scenario

Scenario No. 1: I plan to sell Bitcoin today upon reaching the entry point around $86,100, targeting a drop to $85,000. At around $85,000, I will exit my sales and immediately buy on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome oscillator is below zero.

Scenario No. 2: I can also sell Bitcoin from the upper boundary at $87,000 if there is no market reaction to its breakout back towards the $86,100 and $85,000 levels.

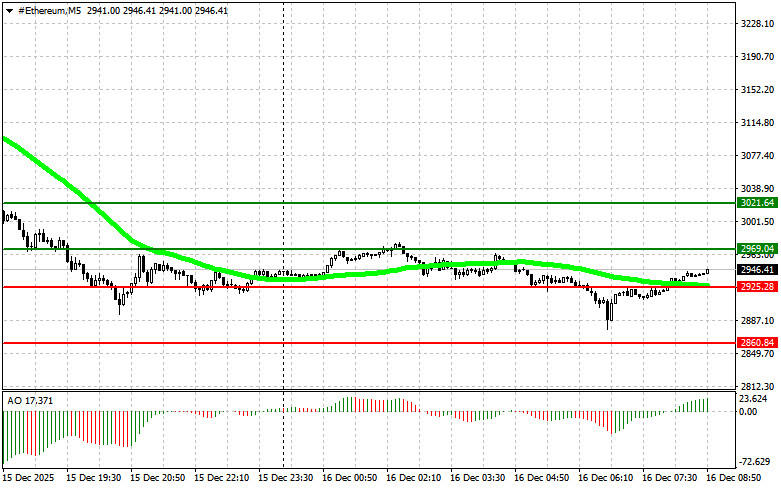

Ethereum

Buy Scenario

Scenario No. 1: I plan to buy Ethereum today upon reaching the entry point around $2,969, targeting growth to the level of $3,021. At around $3,021, I will exit my buys and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome oscillator is above zero.

Scenario No. 2: I can also buy Ethereum at the lower boundary at $2,925 if there is no market reaction to its breakout back towards $2,969 and $3,021.

Sell Scenario

Scenario No. 1: I plan to sell Ethereum today upon reaching the entry point around $2,925, targeting a drop to $2,860. At around $2,860, I will exit my sales and immediately buy on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome oscillator is below zero.

Scenario No. 2: I can also sell Ethereum at the upper boundary at $2,969 if there is no market reaction to its breakout back towards $2,925 and $2,860.