The EUR/USD currency pair soared throughout Tuesday. Initially, it moved up, then down, similar to the GBP/USD pair. We warned that volatility could be extremely high on Tuesday, as more than 10 important reports were scheduled for release throughout the day. However, it turned out that most of them did not even capture the traders' interest. The market had been waiting for only two reports for several weeks—Non-Farm Payrolls and the unemployment rate—and it finally got them.

So, the number of new jobs created outside the agricultural sector in October was... drumroll... -105,000. Non-Farm Payrolls for November came in at +64,000, above the forecast of +50,000. The unemployment rate for November was... 4.6% against forecasts of 4.4%. Thus, if we sum the Non-Farm Payroll reports, we find that over the two missing months, the number of jobs decreased by 41,000. Let's recall that even a theoretical +50,000 is a negative figure, as stable unemployment requires 150,000 to 200,000 new jobs each month.

The Non-Farm Payroll figure counts only new jobs but does not account for layoffs or job losses. Therefore, to cover the average rate of layoffs and job losses, 150,000 to 200,000 new jobs are needed every month. Only in this case will the unemployment rate remain unchanged or decrease. Regarding the unemployment rate itself, its rise to 4.6% needs no further commentary. As we can see, the US labor market remains consistently weak in September and October. This fact significantly increases the likelihood of the Federal Reserve continuing to ease monetary policy in 2026.

Let's remind ourselves that last week saw the last Fed meeting of the current year, during which the decision was made to reduce the key interest rate for the third consecutive time. However, Jerome Powell indicated that there would be a pause in easing at the beginning of the next year, and the "dot plot" showed that the FOMC committee expects only one easing of policy over the next eight meetings. It is likely that one rate cut will not be the only action taken, and there will be no pause at the beginning of the year. In any case, such results of the labor market operation point only to one outcome—the dollar is falling as a logical consequence. It is expected to continue falling under nearly any circumstances, except for a change in the nature of the global fundamental background.

As we have repeatedly mentioned, the problem lies not in the labor market or the Fed. The issue lies with Donald Trump and his policies. As long as the Republican president adheres to a protectionist policy in 2025, the dollar will keep falling. In recent months, we have observed a solid flat, but the upward trend has remained. Now is just a great opportunity to resume it.

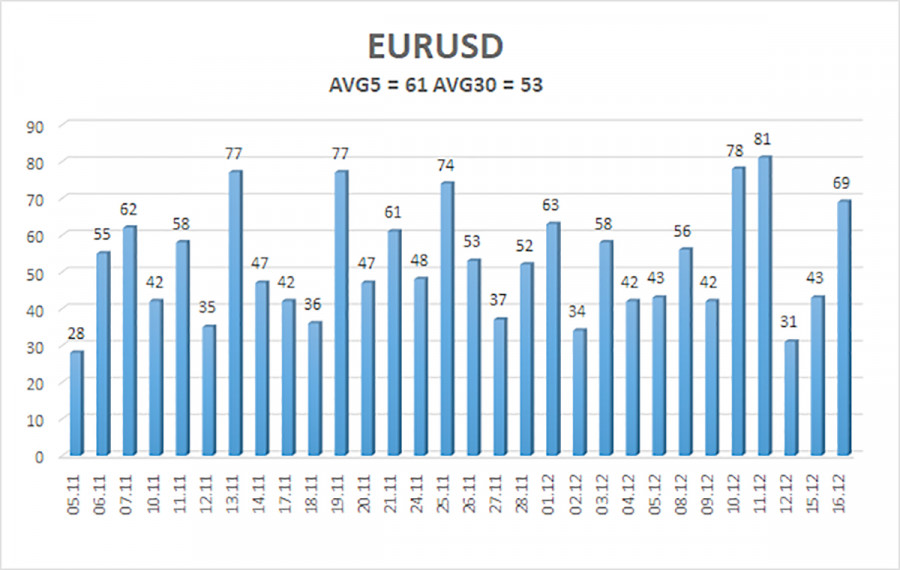

The average volatility of the EUR/USD currency pair over the last five trading days, as of December 17, is 61 pips and is characterized as "average." We expect the pair to trade between 1.1680 and 1.1802 on Wednesday. The upper linear regression channel is pointing downwards, signaling a bearish trend, but the pair is actually flat on the daily timeframe. The CCI indicator entered the oversold area twice in October but visited the overbought area last week. A downward pullback is possible.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1658

- S3 – 1.1597

Nearest Resistance Levels:

Trading Recommendations:

The EUR/USD pair is positioned above the moving average line, maintaining an upward trend across all higher timeframes, while the daily timeframe has been flat for several months. The global fundamental backdrop remains highly significant for the market and is negative for the dollar. In the last six months, the dollar occasionally showed weak growth, but only within the bounds of a sideways channel. There is no fundamental basis for long-term strengthening. If the price is below the moving average, small short positions can be considered targeting 1.1658 and 1.1597 on purely technical grounds. Above the moving average line, long positions remain relevant, with targets at 1.1798 and 1.1830 (the upper line of the flat on the daily timeframe), which have already been practically reached. Now we need the flat to end.

Explanation of Illustrations:

- Linear Regression Channels help identify the current trend. If both are directed in one direction, it means the trend is strong right now.

- Moving Average Line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – target levels for movements and corrections.

- Volatility Levels (red lines) – the probable price channel in which the pair will operate in the coming days, based on current volatility indicators.

- CCI Indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is near.